Digital wealth advisory services

Today, modern financial advisors rely on modern methods to help clients achieve their financial goals. Modern wealth advice is digital, interactive and compliant. We ensure that compliance with legislative requirements, such as MiFID II in the EU or FIDLEG in Switzerland, is automated in systems and processes - so that relationship managers can concentrate on the essentials: Understanding the needs and goals of the customer and serving them convincingly.

Is your method of consulting already up to date? We would be happy to apply our many years of in-depth expertise in the processes and regulations of wealth advisory services to meet your challenges.

Your contact:

Andreas Egli

Head IT Consulting

What distinguishes modern wealth advisory services?

Digitisation makes a decisive contribution to the further development of relationship management and support services. Innovative solutions are available across the entire wealth advisory cycle. They are:

Emotionalised

Bank customers expect new, attractive advisory formats - piles of paperwork are a thing of the past.

Compliant

Compliance with both internal and external requirements is essential - our solutions support you in this.

Integrated

New functions must not be implemented as isolated solutions but integrated into your core banking system.

Proven

Proven solutions build trust - with customers and advisors. Our solutions are successfully in use at many banks.

Which tasks to digitise and how?

For which tasks in the field of wealth advisory services should banks rely on algorithms and automation and where should relationship managers provide intelligent support? As a competent sparring partner, we are happy to develop solutions to these questions, combining expertise, experience and IT skills. We already have established solutions in these areas:

Wealth advisory process

We implement customised end-to-end processes for banks: From risk profiling and needs assessment, to legally compliant investment proposals, portfolio monitoring and scenario simulations.

End-to-end implementationGoal-based investment

A paradigm shift in wealth advisory services is underway: from product orientation to target orientation. The focus here is on the personal plans and goals of the client. Our attractive, digital solutions turn the advisory process into an experience.

Discover goal-based investmentInvestment suitability

Our end-to-end solution ensures regulatory compliance at every step in the process. To manage the business logic, we use the Avaloq Investment Suitability Framework or your preferred solution. To do this, we integrate third-party applications to deliver the required documents (e.g. docRepository or Regulatory Hub).

Portfolio construction

How should the assets be allocated so that risk and return are balanced for investors? For this task, we have already integrated the leading portfolio optimisation products of swissQuant at many banks.

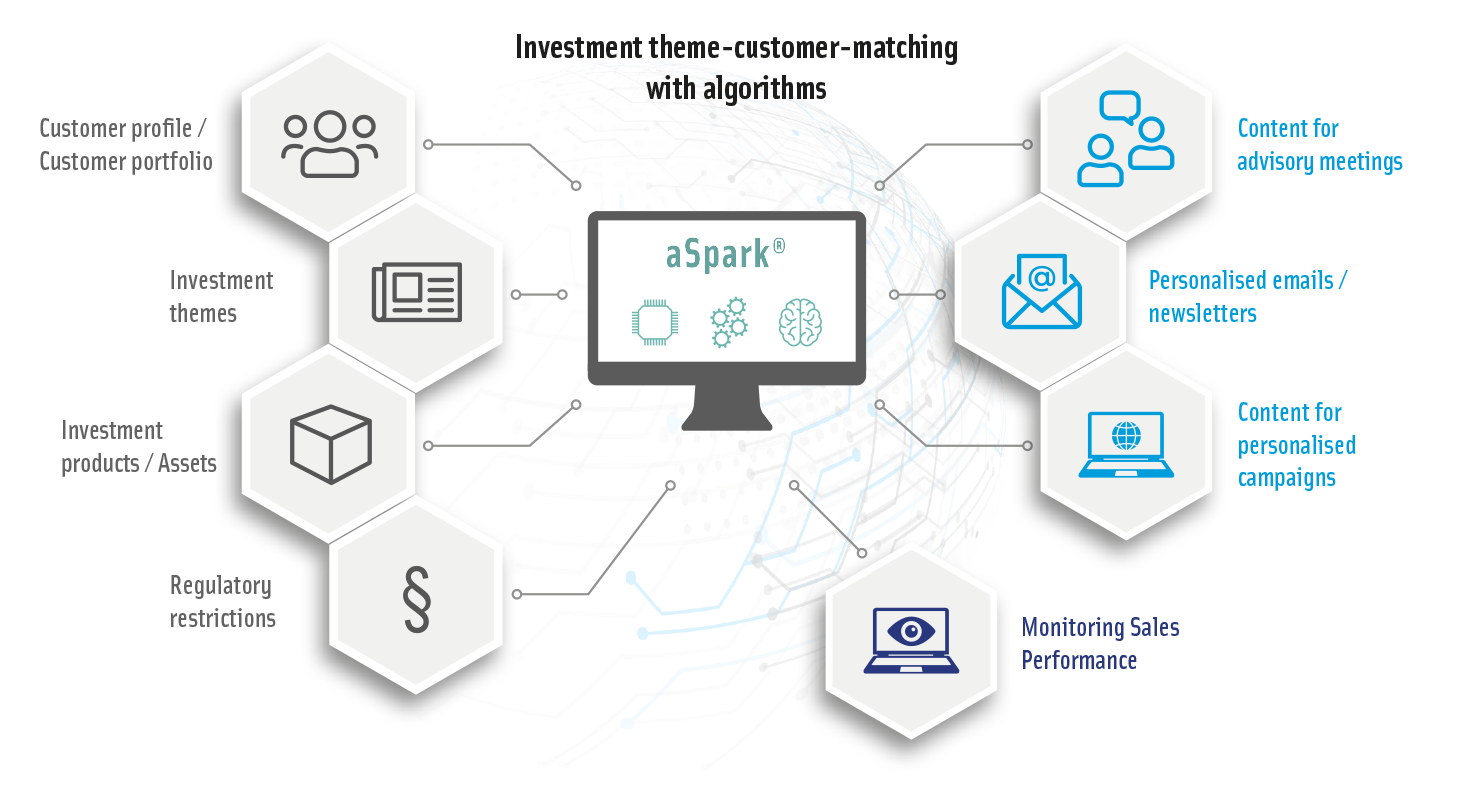

How can you personalise the investment advisory process?

Distributing appropriate investment content to the right clients is often a challenge due to increased client expectations and changing client behaviour. Through targeted automation of processes and the right tool, the scalability of the active and personalised distribution of investment content can be massively increased.